Life Insurance: What It Is, How It Works, and Why You May Need It

Discover what life insurance is, how it works, and why it could be vital for protecting your family, future, and financial peace of mind.

📚 Table of Contents

-

Introduction

-

What Is Life Insurance?

-

How Life Insurance Works

-

Types of Life Insurance Policies

-

Why You May Need Life Insurance

-

When to Get Life Insurance

-

How Much Life Insurance Do You Need?

-

How to Choose the Right Policy

-

Life Insurance for Different Stages of Life

-

Life Insurance and Taxes

-

Common Myths About Life Insurance

-

Frequently Asked Questions

-

Conclusion

-

Resources & References

📝 Article Summary & Sample Sections

1. Introduction

Life insurance may not be the most exciting topic, but it’s one of the most important financial tools you can have. If someone depends on your income—whether it’s your spouse, kids, or even aging parents—life insurance ensures they’ll be financially protected if something happens to you. This guide breaks it down simply: what it is, how it works, and why you may need it.

2. What Is Life Insurance?

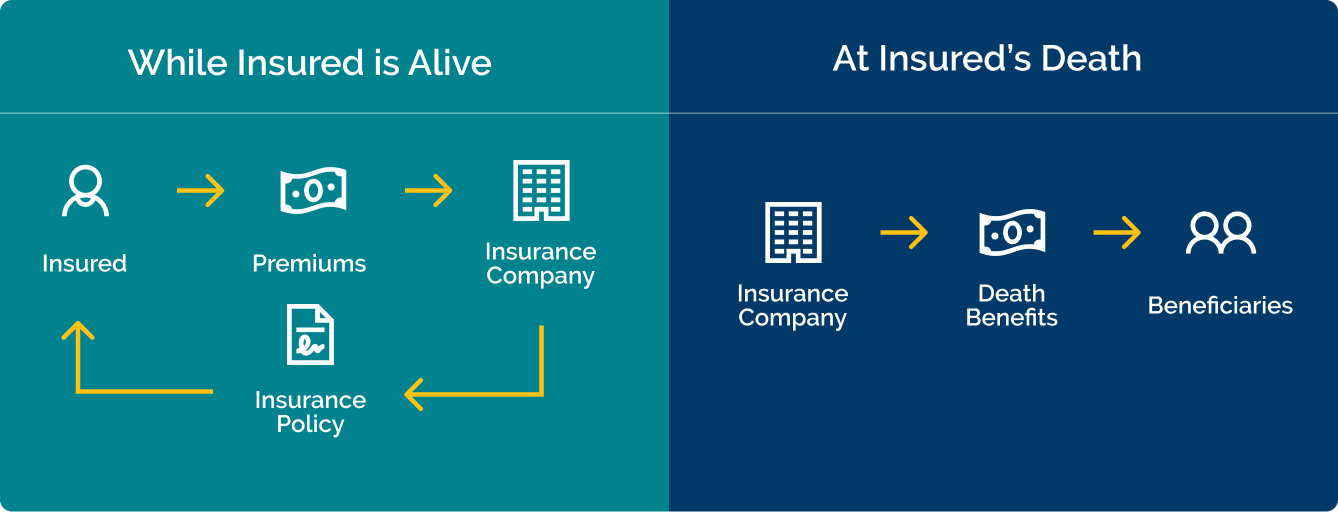

Life insurance is a contract between you and an insurance company. You pay a monthly or yearly premium, and in return, the insurer agrees to pay a death benefit (a lump sum of money) to your chosen beneficiaries when you pass away.

It’s like a financial safety net for your loved ones.

3. How Life Insurance Works

Here’s how the process works:

-

You apply for a life insurance policy.

-

The insurer evaluates your health, age, and lifestyle.

-

You choose a coverage amount and pay premiums.

-

If you die while the policy is active, your beneficiaries receive the payout.

The payout can be used for:

-

Mortgage payments

-

Childcare and education

-

Daily living expenses

-

Funeral costs

-

Paying off debts

The Legal Profession in Sydney: A Closer Look at Lawyers in Australia’s Legal Capital

4. Types of Life Insurance Policies

There are two main types:

a) Term Life Insurance

-

Lasts for a fixed term (e.g., 10, 20, or 30 years)

-

Pays a benefit only if you die during that time

-

Usually more affordable

-

Great for young families and new homeowners

b) Whole Life Insurance

-

Covers you for your entire life

-

Includes a cash value savings component

-

More expensive, but builds long-term value

Other types:

-

Universal life insurance – flexible premiums and coverage

-

Variable life insurance – includes investment options

5. Why You May Need Life Insurance

People get life insurance for different reasons. Here are some of the most common:

-

To replace income if you pass away

-

To help your spouse or partner stay financially stable

-

To ensure your children can go to college

-

To pay off debts, including mortgage or loans

-

To cover final expenses (like a funeral)

-

To leave behind a legacy or charitable gift

If anyone would suffer financially from your absence, you likely need life insurance.

6. When to Get Life Insurance

There’s no perfect time—but sooner is often better. The younger and healthier you are, the cheaper your premiums.

Good times to consider getting it:

-

When you get married

-

When you buy a house

-

When you have a child

-

When you start a business

-

When you take on debt with someone else

7. How Much Life Insurance Do You Need?

A common rule is the “10x Rule” — aim for 10 times your annual income. But more accurate methods include:

-

Adding up your total debts, expenses, and future financial needs

-

Subtracting savings, assets, and existing insurance

You can also use online calculators to get a quick estimate.

8. How to Choose the Right Policy

Here’s what to consider:

-

Your age and health

-

Your financial obligations (mortgage, kids, etc.)

-

Your budget

-

How long you need coverage

Also, compare quotes from multiple insurers. Look at reviews, claim history, and flexibility.

9. Life Insurance for Different Stages of Life

In Your 20s or 30s

-

Get term insurance early—it’s cheaper

-

Start building financial responsibility

In Your 40s or 50s

-

Reassess your needs as kids grow up or debt changes

-

Consider adding whole life or final expense insurance

In Your 60s or 70s

-

Focus on legacy, estate planning, or funeral coverage

-

May be harder and costlier to get coverage

10. Life Insurance and Taxes

-

Death benefits are usually not taxable

-

Cash value (from whole/universal policies) may grow tax-deferred

-

Some estate tax implications if your policy is large

Talk to a tax advisor for high-value policies.

11. Common Myths About Life Insurance

-

❌ “It’s only for parents” – Single people can use it to cover debt or burial

-

❌ “It’s too expensive” – Term insurance can cost less than $1/day

-

❌ “I have it through work, that’s enough” – Employer coverage often isn’t portable or enough

-

❌ “I’m too young to think about it” – Younger = cheaper

12. Frequently Asked Questions

Q: Can I get life insurance if I have health issues?

Yes, though your premium may be higher. Some no-exam policies exist.

Q: Can I change my beneficiary later?

Yes, you can usually update it any time.

Q: What happens if I stop paying premiums?

Your policy may lapse, or reduce coverage (depending on type).

Q: Is life insurance worth it?

If someone depends on you, absolutely.

13. Conclusion

Life insurance is more than just a contract—it’s peace of mind. It protects the people you love from financial hardship during the worst times. Whether you’re young, married, single, or retired, having the right life insurance policy can make a real difference in the lives of those you care about.

🔗 Resources & References

🏷️ Tags

life insurance, term life insurance, whole life insurance, how life insurance works, why get life insurance, life insurance coverage, financial protection